Insights First Half 2025

ACKER MARKET INSIGHTS

FIRST HALF OF 2025

NEW YORK - July 1, 2025

SHARE

INTRODUCTION

The first half of 2025 was shaped by significant geopolitical developments, most notably the Trump administration’s tariff policies and a notable decline in the U.S. dollar against major global currencies. These macroeconomic shifts had far-reaching effects on the global wine market. Despite these headwinds, Acker’s Fine Wine auction volume rose by 20%, and our global retail business grew by 8% with the average price per bottle sold rising 15%. The Acker Fine and Rare Index posted a modest yet stable gain of 1%, exhibiting minimal volatility at a time when most other asset classes experienced heightened fluctuations—further reinforcing fine wine’s status as a reliable store of value with superior risk-adjusted returns during periods of global market uncertainty.

Tariffs and currency movements are expected to influence European wine pricing in the foreseeable future which will lead to a trend toward regionalization in the auction market. Collectors will increasingly choose to sell within their own regions—Europe, Asia, or the United States—while gravitating toward global auction houses with established regional infrastructures and robust local client bases. Our inaugural Switzerland auction is a prime example of this trend, featuring European collections that saw strong demand from both European and Asian buyers, with limited participation from the United States.

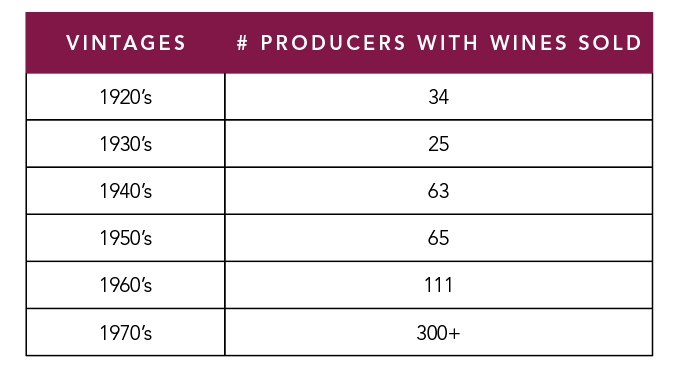

Within the fine wine segment, demand for older vintages—particularly pre-1990 across all regions—was the standout theme in the first half of the year. These wines delivered significant price appreciation, with many increasing by over 50%, fueled by insatiable demand, especially for pre-1980 vintages across both auction and retail. This trend shows no signs of slowing and is expected to continue through the second half of 2025. The wide variety of older vintage wines offered, spanning numerous producers, further reflects this activity.

The table below illustrates this by showing the number of different producers with wines sold by decade across all regions:

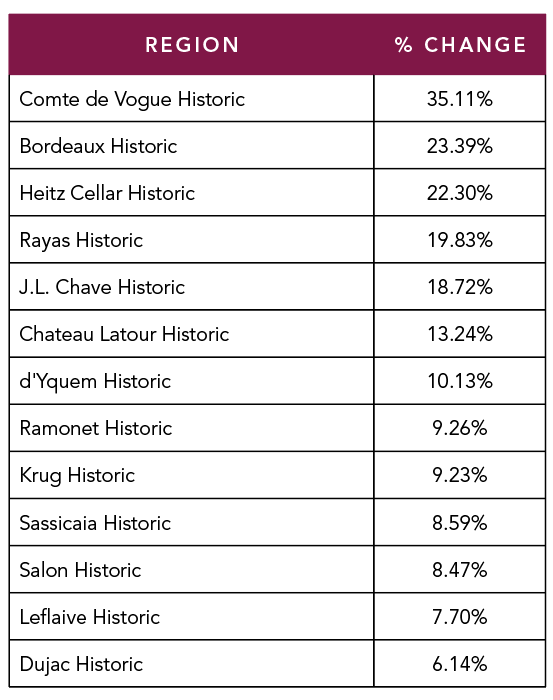

The top performing indices for the first half of the year were dominated by older wines with some highlights below:

TOP PERFORMING HISTORIC INDICES

*Historic Indices are comprised of a selection of the most traded wines from a given producer before the year 2000. The selection of wines and the index’s pricing scale are static as of the index’s creation date.

Shifting Dynamics in New Vintage Pricing and Allocation Turnover

For the first time in many years, we are observing notable resistance to price increases on newer vintage allocations, contributing to an oversupply of young wines in the market and putting downward pressure on prices. This trend appears to reflect broader challenges in the digestion of new releases, particularly as producers increasingly aim to capture a larger share of the final retail price through allocation pricing.

Traditionally, collectors would retain most of their allocations, selling a small portion to take advantage of the pricing differential between allocation and market value—effectively lowering their net cost of acquisition. With this margin largely compressed, buyers are now more frequently turning over allocations soon after receipt, especially for vintages not viewed as outstanding. This shift has increased market liquidity for younger vintages, which in turn has begun to pressure pricing. Top producers have grown more sensitive to the optics and pace of resale, but the root issue is the pricing structure itself.

This dynamic was also reflected in the 2024 Bordeaux En Primeur campaign, which sparked an unusually candid discussion from long-standing wine critics about the campaign model. With U.S. buyers facing 10% tariffs, a 10% decline in the dollar, and the opportunity cost of capital tied up for several years adding another 8–15%, many longstanding purchasers have found the economics increasingly difficult to justify. While En Primeur remains a critical pillar of Bordeaux’s distribution model, this year’s campaign has reignited questions around pricing, value, and financing structures and put pressure on prices of recent Bordeaux vintages.

SUMMARY

We see the Auction and Retail Fine Wine market staying robust for the remainder of 2025 and the trend of regionalization becoming more pronounced. As one of the few truly global auction houses with the broadest international client base, Acker is uniquely positioned to preserve and build upon the 30–40% market share we have consistently held in recent years. We are revising our forecast for price appreciation for 2025 and 2026. Initially we anticipated an overall 15-20% rise over the two-year period. Our updated forecast maintains the 15-20% increase but only for wines with vintages prior to 2000. This expectation aligns with the anticipated easing policies of the Federal Reserve later this year. However, younger vintages will not experience the same price increases due to the previously mentioned issues with allocation pricing and distribution models, which are expected to keep the prices of these younger wines stable. Overall, fine wine continues to demonstrate the key characteristics of a stable asset class with strong long-term return potential.

Wishing everyone a relaxing and enjoyable summer.

IRVIN GOLDMAN

Chief Executive Officer